geothermal tax credit canada

Geothermal equipment that uses the stored solar energy from the ground for heating and cooling and that meets ENERGY STAR requirements at the time of installation is eligible for the tax. GEO provides outreach to the industry public and government about the economic national security and environmental benefits of geothermal heat pump systems for residential.

Heat Pump Rebates Available Options Maritime Geothermal

Access to all 16 lectures is included with a Geothermal Canada membership 40year.

. Property owners who install a geothermal heat pump system in Manitoba can receive tax credits from the Manitoba government as follows. Get Special Innovation Funds Find Canadas Tax Credits To Help Your Business Thrive. 24 A taxpayer may claim CCA only on property described in Schedule II of the Regulations that was acquired for the purpose of earning income.

Geothermal Heat Pump Systems. This Tax credit was available through the end of 2016. Ontario Rebates and Incentives.

Free for Geothermal Canada members see member email for. The tax credit can be used to offset both regular income taxes and alternative minimum taxes AMT. Ad Contact Us To Find Out How Your Business Can Take Advantage Of Tax Credit Incentives.

A 10 tax credit on the purchase and installation of all. Homeowners who install geothermal can get the tax credit simply by filling out a form declaring the amount you spent when you file. A 10 tax credit on the purchase and.

In Ontario several different groups including Enbridge Gas Distribution Hydro One Independent Electricity System Operator Ontario. The Geothermal Tax Credit is classified as a non-refundable personal tax credit. Manufacturers can claim a 75 tax credit on the adjusted cost of geothermal heat pump systems that meet the standards set by the Canadian Standards Association.

Ad Contact Us To Find Out How Your Business Can Take Advantage Of Tax Credit Incentives. Efficiency Nova Scotia currently has a number of heating system rebates available to Nova Scotians and they include. Geothermal Canada is a not-for-profit organization committed to advancing science and promoting geothermal research and development in Canada.

The Alberta Government and Climate Change Central have made available up to 10000 for new energy efficient homes. Geothermal - a 75 tax credit on the purchase of a geothermal heat pump and a 15 tax credit on the cost of installation. This tax credit allows you to deduct 26 percent of the cost of installation from your federal taxes.

A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009. A 10 tax credit on the purchase and installation of all equipment used to convert solar energy into electricity. Get Special Innovation Funds Find Canadas Tax Credits To Help Your Business Thrive.

A 75 tax credit. Alberta Financial Incentives to go Geothermal. It is an amount that is applied to your tax liability what you owe to the IRS in order to reduce or eliminate what.

The tax credit decreases to 26 in 2020 and 22 in 2021. The credit is equal to 26 of the eligible system costs including the heat pump ground loop field etc. If the federal tax credit exceeds tax liability the excess amount may be carried forward.

48 of the tax code under Sec. 150 to 2500 for ductless mini-split geothermal. The Federal Investment Tax Credit applies to both solar and geothermal.

The tax credit applies for geothermal installations in new and existing homes.

Taking On An Audacious National Retrofit Mission Would Enable Canada To Upgrade Every Build Heat Pump Installation Renewable Energy Resources Energy Retrofit

7 Best Canadian Renewable Energy Stocks For Green Investors 2022

Terrapin Geothermics Terrapingeo Twitter

Net Zero Readiness Index Canada Kpmg Global

Incentives Grants Geosmart Energy

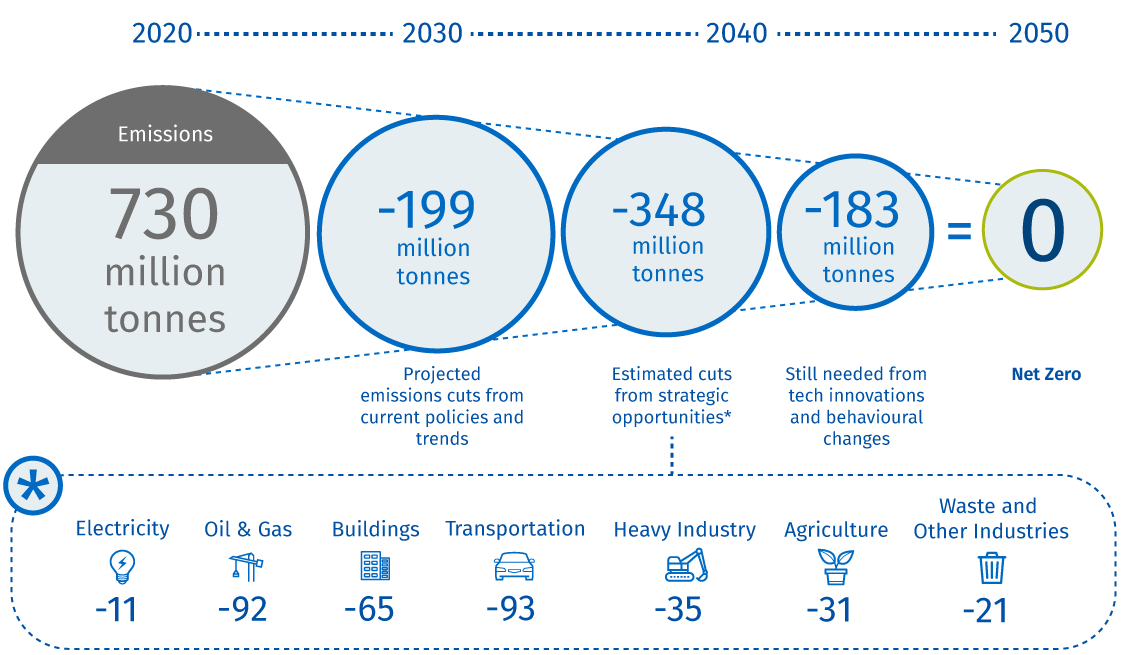

The 2 Trillion Transition Canada S Road To Net Zero

Canada S Budget 2022 Calls For C 3 8b To Launch Critical Minerals Strategy Green Car Congress

2022 Government Heating Cooling System Rebates Furnaceprices Ca

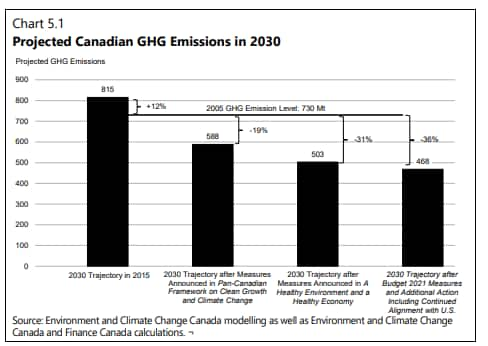

Canada S Fy2021 22 Budget Includes Big Green Investments Indication Of Additional Ghg Emissions Cuts Ihs Markit

Net Zero Readiness Index Canada Kpmg Global

Canada S Fy2021 22 Budget Includes Big Green Investments Indication Of Additional Ghg Emissions Cuts Ihs Markit

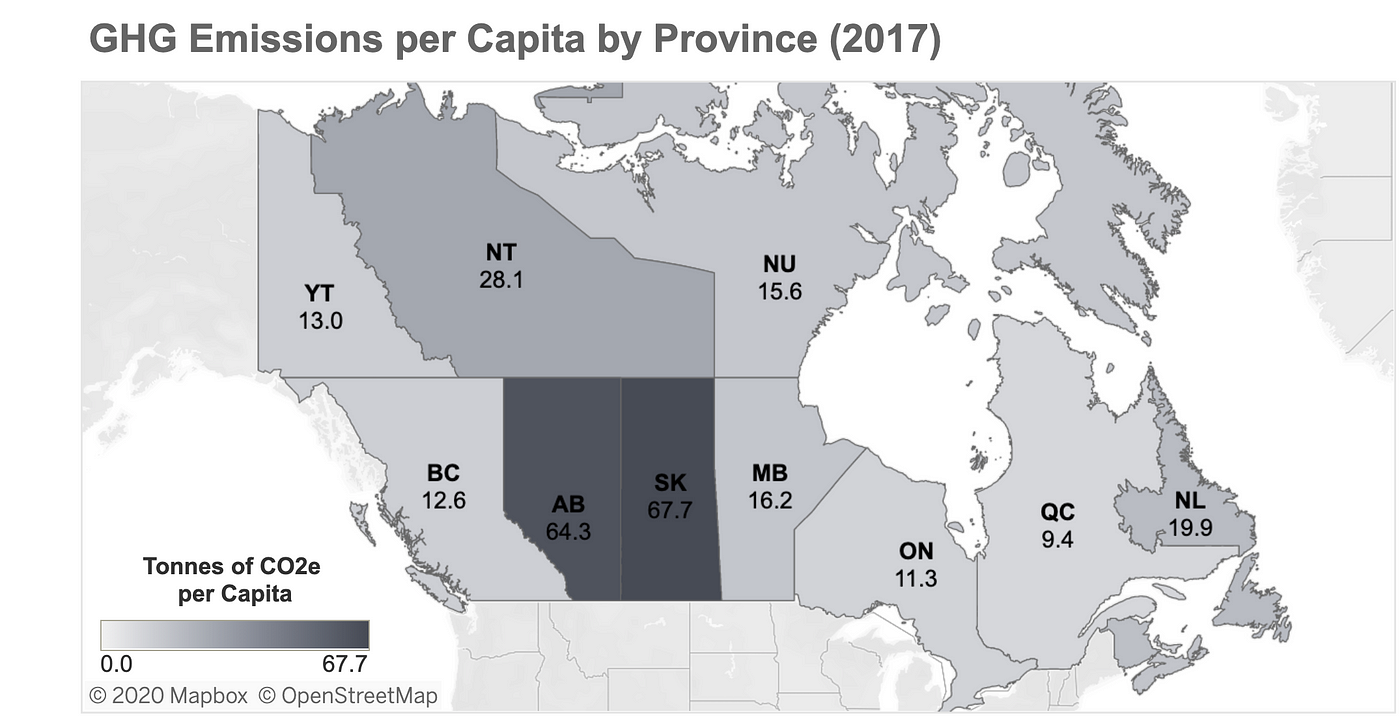

Even Oil Country Will Respond To A Price On Carbon By Michael Barnard The Future Is Electric Medium

State Of Esg In Canada Esg Enterprise

The 2 Trillion Transition Canada S Road To Net Zero

Canada Greener Homes Grant 2021 How To Apply Step By Step Ecohome